Systems4PT’s Guide to Patient Billing and Collections

Part Four: Self-Pay Balances and Aging Reports

Self-Pay Reports

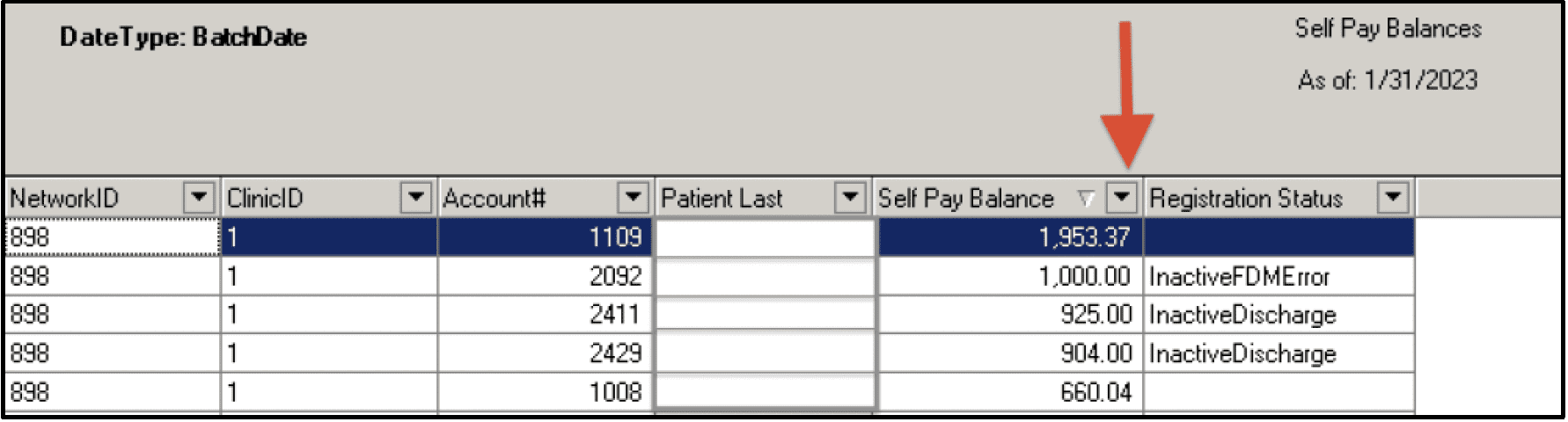

Use these reports to decide how you want to tackle the invoicing process. Do you want to work from the largest balances to the smallest? Do you want to work oldest balances first? Whatever you decide, sort the columns in your reports appropriately and start reviewing each account to be sure you know why this money is outstanding and what has been done to date in collecting this money.

Self-Pay Balance Report

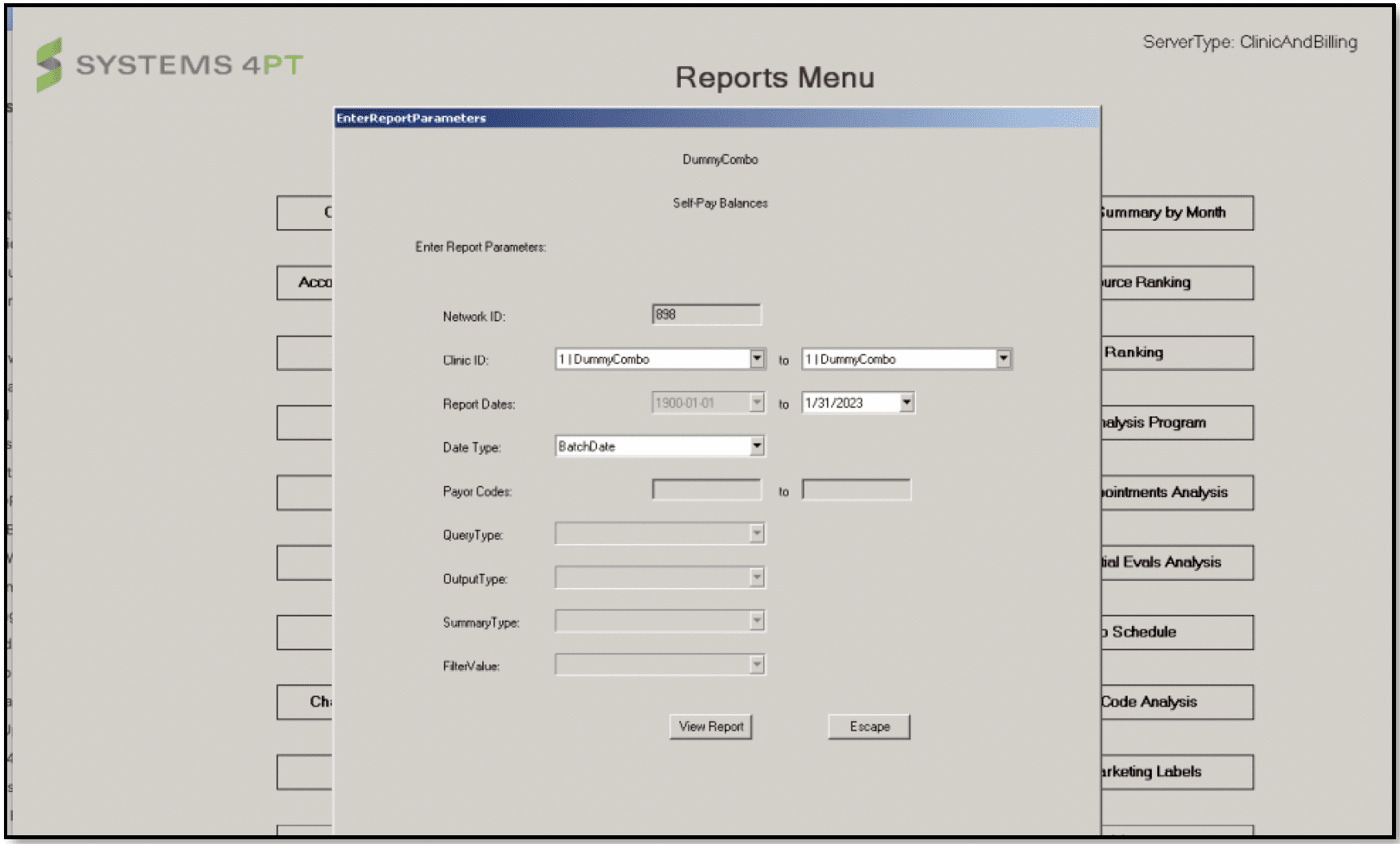

The Self-Pay Balances report will provide you with a list of patients who owe you money. This could be their co-pay, co-insurance, deductible, or self-pay charge. When selecting the parameters for this report it is recommended that you chose to run by “BatchDate”, not “TransDate” for the most accurate data. If you are a multi-clinic site, you will have the option of running the report for all clinics or each clinic individually. Always remember to change the Report Dates “to” date to the most current date.

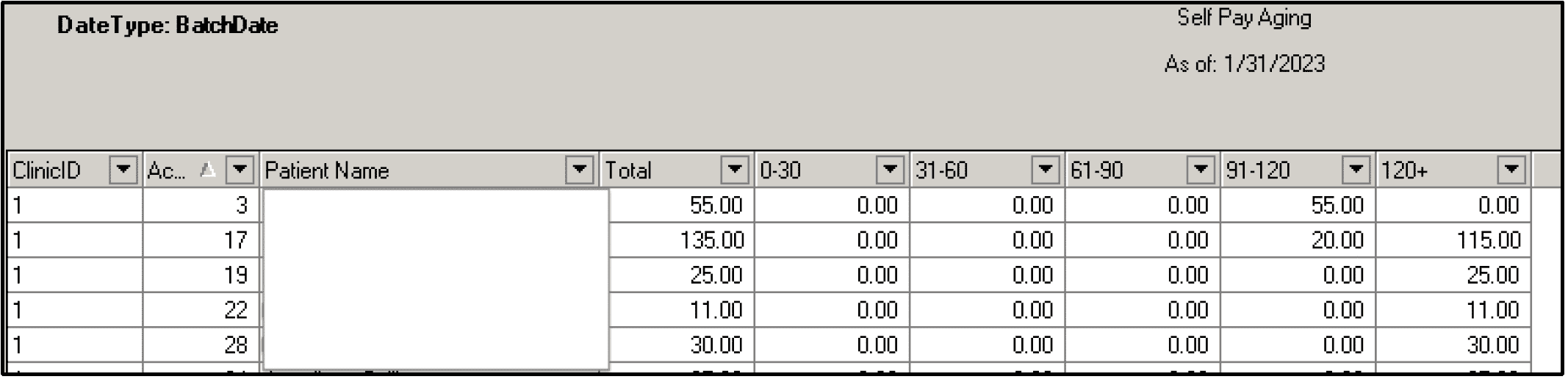

Self-Pay Balance Aging

Next, open your Self-Pay Balance Aging. Like the Self-Pay Balances, the money due is co-pay, co-insurance, deductible, and/or self-pay charge which includes DME. When selecting the parameters for this report it is recommended that you chose to run by “BatchDate”, not “TransDate” for the most accurate data. If you are a multi-clinic site, you will have the option of running the report for all clinics or each clinic individually. Always remember to change the Report Dates “to” date to the most current date. Keep in mind when looking at these balances, money posted to the Patient Processing Screen (PPS) and Patient Cash Posting Screens will be updated on this report immediately for single-site clinics but will not change on multi-site clinics until the next day.

The self-pay balance aging report is broken down into “buckets”. These are 30-day periods from the time of the patient visit to the present. If a patient visit was on January 2nd and payment was still not received as of April 4, the charges would appear in the 60-90 day bucket. You want to work these accounts at least monthly. It’s up to you if you want to review the “old” money or “new” money first. Depending on which “bucket” you are going to work on, you can click on the triangle at the top of the column and sort largest to smallest or vice-versa.

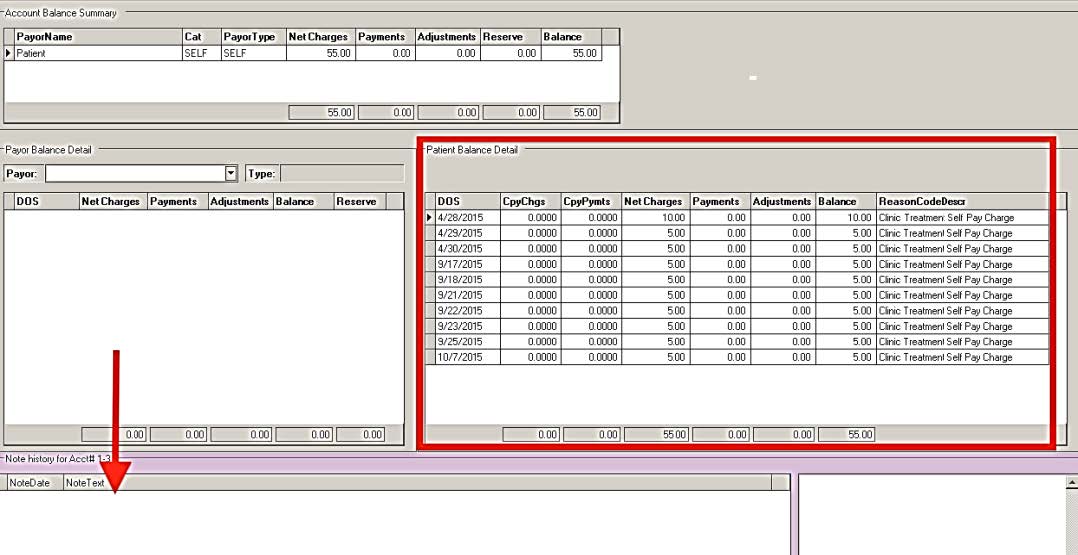

For each account, go to the PAD (Patient Account Detail) screen on your FOCUS menu and review that patient’s account. Check the notes that are posted to see what has been done since the last time you reviewed the account. If you have any questions about the charges and payments, send a message to your FOCUS rep via the FRS. Allow a week for FOCUS to review your questions and respond.

Check your invoice history for this account and send the correct next level invoice based on your dunning process.

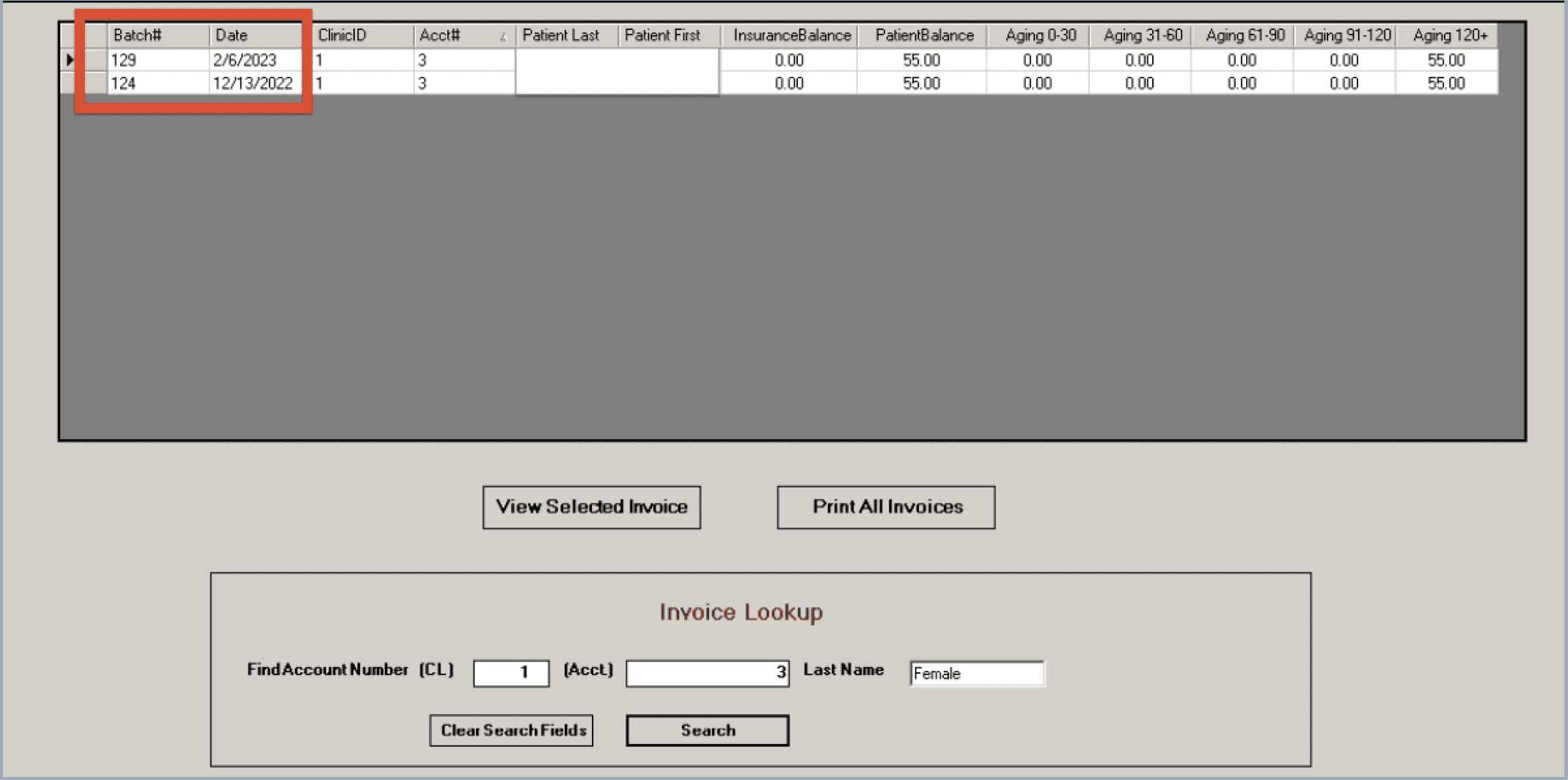

“New Invoice” Under Corporate Reports Menu/Invoice History

Now that you have familiarized yourself with the patient’s account and have answered any questions regarding the amount due, you are ready to produce and send the invoice to the patient. More details on invoicing and dunning processes are covered in the next issues of the Patient Billing and Collections series.

If you would like a copy of this guide to download for your own personal reference, please use the download button below to obtain a copy in PDF format. Check back for more Systems4PT guides and updates!

At Systems4PT we provide an ALL USA BASED team that gets you PAID MORE, PAID FASTER, that COSTS LESS, and we only get paid AFTER you get paid!

More Articles by Systems4PT

Busting PT Myths: “Physical Therapy is Just Exercise”

Busting PT Myths: "Physical Therapy is...

Busting PT Myths – Physical Therapy Is Only for Recovery

Busting PT Myths "Physical Therapy is...

Busting PT Myths – Physical Therapy Is Too Time Consuming

Busting PT Myths "Is Physical Therapy Too...